While Chinese officials continue to downplay the likelihood of more aggressive easing, the economy has been slow to respond to a host of earlier stimulus measures

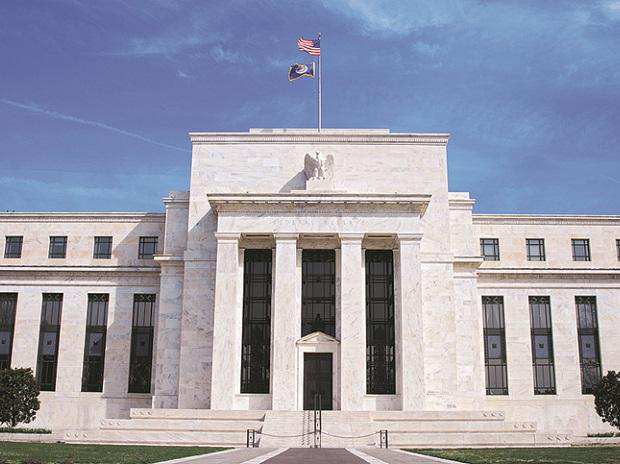

International:-China’s national bank could cut its benchmark approach rate without precedent for a long time if the US Federal Reserve conveys a generally anticipated cut in late July, experts state, as Chinese policymakers venture up help for the abating economy.

Market watchers, in any case, accept the People’s Bank of China (PBOC) is bound to pursue any US rate cut by bringing down its key transient currency market rates.

It would not be the first run through the PBOC has pursued the Fed’s lead. In 2017 and 2018, the bank collected momentary cash rates hours after U.S. climbs, despite the fact that in increasingly humble and representative moves of 5 to 10 premise focuses.

While Chinese authorities keep on minimizing the probability of increasingly forceful facilitating, the economy has been moderate to react to a large group of prior boost measures, while the US-China exchange war is developing longer and costlier.

A few investigators trust GDP development is nearing the lower end of the administration’s 2019 target scope of 6-6.5%, fortifying desires that more help is required soon.

In an offer to goad all the more loaning, the PBOC has infused immense measures of liquidity into the money related framework in different structures over the previous year, targetting little and privately owned businesses specifically. It additionally has unobtrusively guided some transient rates lower to diminish corporate financing weight.

However, examiners state that has not kicked off venture as much as arranged, as the dubious business viewpoint leaves organizations careful about making the crisp speculations expected to unfaltering the economy. They state a framework wide cut in loan fees may offer battling firms increasingly quick help.