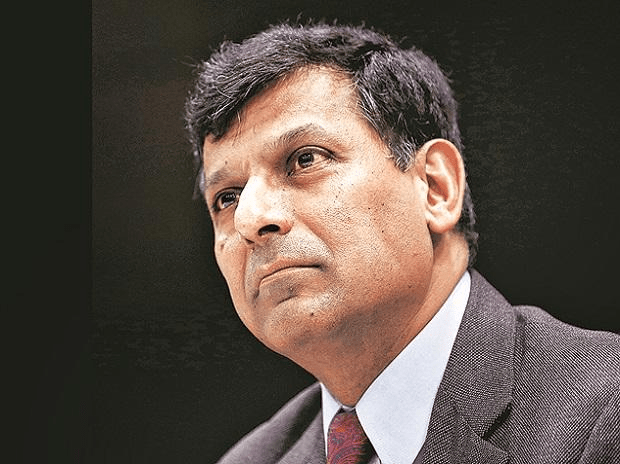

Rajan said bank mergers are a step in the right direction but did not come at a right time

Current Affairs:Previous Reserve Bank of India (RBI) representative Raghuram Rajan has somewhat accused an absence of “enticing” vision and a lot of centralisation of intensity under the present government for the financial wreckage that the nation is in today.

Conveying the O P Jindal address at Watson Institute, Brown University, Rajan additionally said the framework doesn’t acknowledge individuals all things considered, however divisions like financial need outside mastery.

Rajan brought up that the ongoing cut in partnership expense rates has been helpful yet the vulnerability as far as changes in the duty system turns into a dampener for firms. “We have a propensity for going to and fro. The degree of FDI (outside direct speculation) hasn’t changed much notwithstanding changes,” he said.

On the RBI cutting the repo rate for the fifth sequential time, he said the slices won’t be passed on to clients as the financial framework itself is pushed.

Rajan said bank mergers are a positive development however didn’t come at an opportune time. “Bank mergers are coming when the banks are managing elevated levels of NPAs (non-performing resources) and at a time the economy is easing back… Banks will be overwhelmed in dealing with the mergers throughout the following couple of years as opposed to concentrating on improving credits,” he included.

Assaulting the model of the Prime Minister’s Office (PMO) under the occupant Narendra Modi and his ancestor Manmohan Singh, the previous RBI senator upheld a center ground, seen during the Atal Bihari Vajpayee residency.

“What Modi has done is centralisation of intensity in the PMO though conversely we had a framework in UPA 1 and 2 where it was finished decentralization of intensity. To me nor is great.