On the tepid credit growth, Kumar said he expects some pick up during the second half

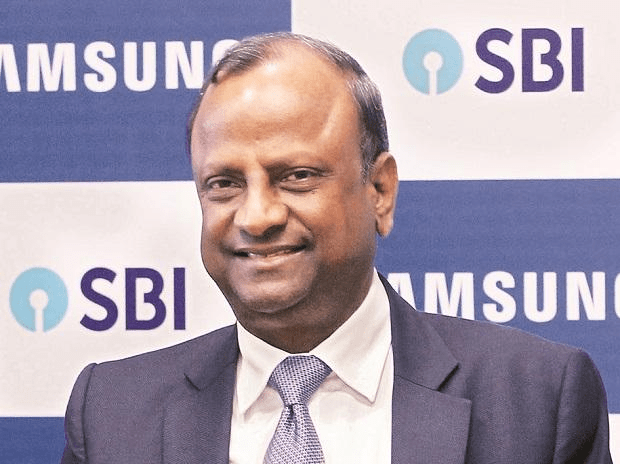

Current Affairs:With expanding instances of store preoccupations, banks have met up and empanelled upwards of 83 oversight organizations to keep a tab on the end-utilization of advances, State Bank executive Rajnish Kumar said Thursday.

The chairm of the biggest moneylender said there have been occasions where an individual or an organization has obtained from one bank and simultaneously utilizes a present record office with some other bank to redirect reserves.

“Procuring oversight organizations is something being finished by banks to counteract such abuse,” Kumar told correspondents.

He likewise proposed that techniques for loaning should experience change.

“The consortium discipline or the numerous financial control must be improved and there the controller likewise needs to pay a job,” he said.

On the lukewarm credit development, Kumar said he expects some get during the subsequent half.

“In the event that you take a gander at the year-on-year development, we are seeing 13 percent. Ideally, if this proceeds or stays at a similar level in the subsequent half, we will be exceptionally glad. Just constantly half we will realize how a lot of credit is required,” Kumar said.

Discussing the liquidity conditions, he said at the sectoral level, there is sufficient liquidity in the framework as the RBI reported numerous measures following the financial backing to improve liquidity for NBFCs.