The government is looking to list 2% of the company on the Saudi bourse rather than listing the entire share capital on the exchange, the sources said.

Current Affairs:The Saudi government will be dependent upon a one-year confinement on selling extra Aramco shares in the oil organization after an arranged first sale of stock (IPO), three sources acquainted with the issue said.

The legislature is hoping to list 2% of the organization on the Saudi bourse instead of posting the whole offer capital on the trade, the sources said.

Typically open organizations list the whole offer capital on the trade and have a bit of that as free buoy.

Aramco was not quickly accessible to remark.

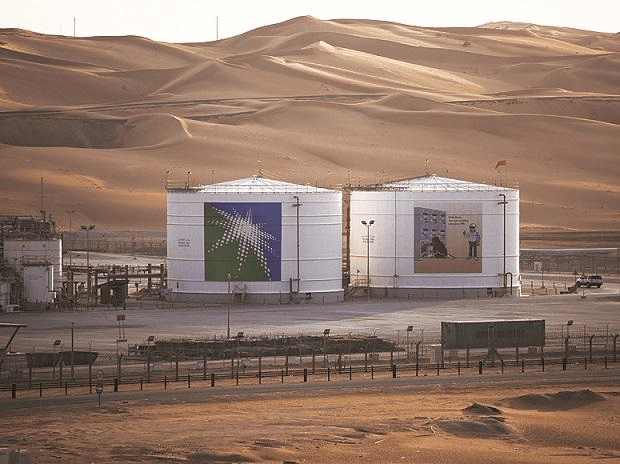

Aramco, the world’s most gainful organization, discharged the beginning weapon on a residential IPO on Sunday, in what could be the world’s greatest posting as the realm looks to enhance its economy away from oil.

Sunday’s announcement said Aramco and the selling investor will be dependent upon limitations on the deal, demeanor or issuance of extra offers, however didn’t give the lockup time frame.

Aramco roadshows will start Nov. 18 and last estimating is booked for Dec. 5, sources stated, adding Aramco is relied upon to begin exchanging on Dec. 11.