Speaking on the occasion, Union Bank managing director Rajkiran Rai G said, through the hundred years journey, the bank has been serving national priorities.

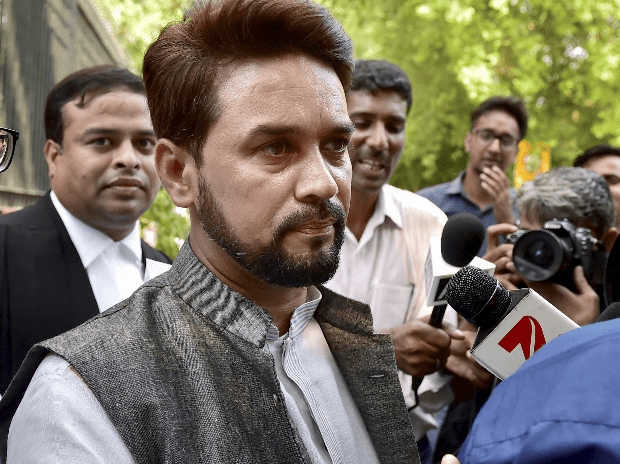

Current Affairs:Junior money serve Anurag Thakur on Monday solicited banks to guarantee smooth stream from credit to MSMEs which are in veritable need of assets.

It very well may be noticed that notwithstanding numerous estimates declared by progressive governments, independent ventures keep on confronting subsidizing issues, as banks don’t pursue them as they do with huge organizations for an assortment of reasons.

“Banks ought to likewise concentrate on certified clients who need budgetary help to develop their organizations and the MSME segment, which is the foundation of our economy, needs a great deal of help from the financial business,” he said at the 101st establishment day festivities of the state-run Union Bank of India here tonight.

Drilling down the large number of changes taken in the financial segment, he stated, “we have received the four R way to deal with settle the monetary record issues of banks: perceiving, settling and recuperating, recapitalising and changes”.

Therefore, terrible advances have descended from Rs 10.36 lakh crore in March 2018 to Rs 9.38 lakh crore in March 2019 framework wide, while for open area banks, the equivalent has come down to Rs 7.9 lakh crore from Rs 8.96 lakh crore.

He additionally asked banks to authentic business choices unafraid of witch-chase later.

Talking on the event, Union Bank overseeing chief Rajkiran Rai G stated, through the hundred years venture, the bank has been serving national needs.

The bank propelled three new items – Union Sampurna-an innovation to give one-stop answer for ranch area; e-way charges and an ATM geo-locator.