China’s stock, currency and bond markets have all been closed since Jan 23 and had been due to re-open last Friday

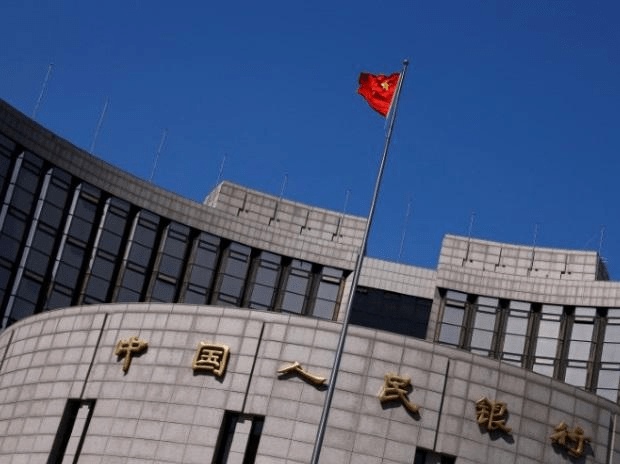

Current Affairs:China’s national bank said it will infuse 1.2 trillion yuan ($174 billion) worth of liquidity into the business sectors by means of switch repo tasks on Monday as its financial exchanges get ready to revive in the midst of an episode of another coronavirus.

Chinese specialists have vowed to utilize different money related arrangement devices to guarantee liquidity remains sensibly abundant and to help firms influenced by the infection pandemic, which has so far asserted 305 lives, everything except one in China.

The People’s Bank of China made the declaration in an announcement on Sunday, including the absolute liquidity in the financial framework will be 900 billion yuan higher than a similar period in 2019 after the infusion.

As per Reuters counts dependent on legitimate national bank information, 1.05 trillion yuan worth of switch repos are set to develop on Monday, implying that 150 billion yuan in net money will be infused. Financial specialists are supporting for an unstable session in Chinese markets when coastal exchanges continue on Monday after a break for the Lunar New Year which was reached out by the legislature.

China’s stock, cash and security markets have all been shut since Jan. 23 and had been because of re-open last Friday. There will be no further postponements to the reviving, the protections showcase controller said in a meeting in the People’s Daily paper on Sunday.