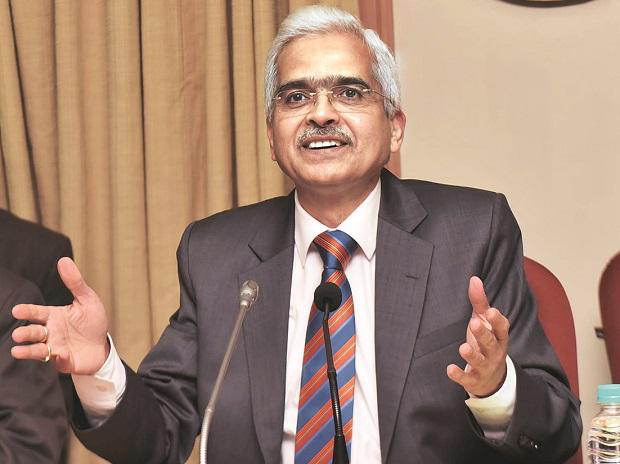

The policy decision will be announced at 11:45 a.m. in Mumbai, followed by a press conference 15 minutes later by Shaktikanta Das

Economy:- The Reserve Bank of India is probably going to bond its situation as Asia’s most hesitant national manage an account with a third straight loan cost cut Thursday.

The six-part financial arrangement board of trustees driven by Governor Shaktikanta Das will decrease the repurchase rate by 25 premise focuses to 5.75% on Thursday, state 31 of 43 business analysts reviewed by Bloomberg, while three are penciling in 50 premise focuses cut. The RBI may likewise change its position to accommodative from impartial, given that desires are developing for the Federal Reserve to slice rates this year.

Expansion that is remained nearby to the lower end of RBI’s 2-6% band for a half year has given policymakers space to help financial development. India is among national banks crosswise over Asia moving to looser money related strategy to support their economies in the midst of dangers from the U.S.- China exchange war. Philippines, Malaysia and New Zealand facilitated a month ago, while Australia cut financing costs this week without precedent for just about three years.

The approach choice will be declared at 11:45 a.m. in Mumbai, trailed by a public interview 15 minutes after the fact by Das. Here’s a glance at what else to watch out for in the choice that comes a long time before the new government’s yearly spending plan on July 5: