Move to cover fresh retail, MSME loans from Oct 1; home, auto loans to get cheaper

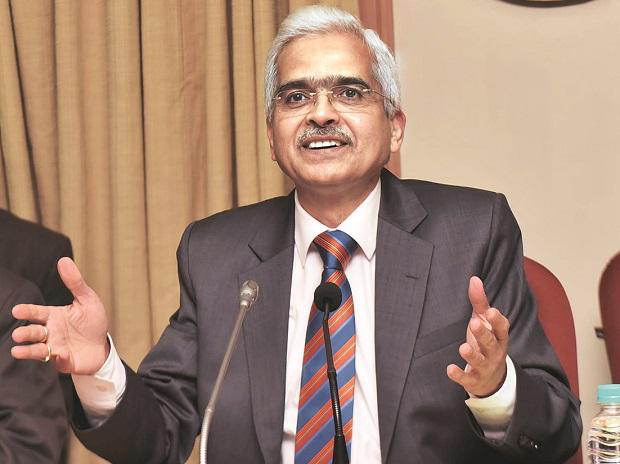

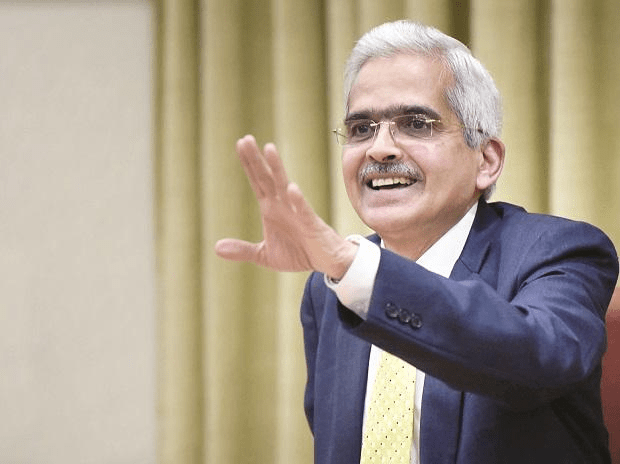

Current Affairs:-The Reserve Bank of India (RBI) on Wednesday made it obligatory for banks to connect all their new retail advances to an outer benchmark, powerful October 1 — the national bank’s repo rate being one such benchmark.

All open area banks have moved to such a system deliberately, while private banks are yet to. The state-run banks have presented repo-connected items for skimming rate home and vehicle advances, however the RBI said credits to miniaturized scale, little and medium undertakings (MSMEs) ought to likewise be connected to an outer benchmark.

The three outside benchmarks the RBI proposed are arrangement repo rate, the Government of India’s three-month and half year treasury bill yields distributed by Financial Benchmarks India Private (FBIL), or some other benchmark market loan fee distributed by FBIL.

The national bank revised its lord bearings on financing cost on advances as well, mirroring the changes.

A few banks do compute their minor expense of assets based loaning rate (MCLR) in light of the three-and half year treasury bills, yet the RBI said “it has been seen that because of different reasons, the transmission of strategy rate changes to the loaning pace of banks under the current MCLR structure has not been acceptable”.

Banks are allowed to offer such outer benchmark-connected advances to different kinds of borrowers too, however the banks must embrace a uniform outside benchmark inside an advance classification, to guarantee straightforwardness, institutionalization, and simplicity of comprehension of credit items by borrowers.

“Banks are allowed to choose the spread over the outer benchmark. Be that as it may, credit chance premium may experience change just when borrower’s credit appraisal experiences a considerable change, as settled upon in the advance contract,” the RBI said.

Different parts of spread, including working expense, could be changed once in three years. The loan cost under outside benchmark ought to be reset “at any rate once in a quarter of a year”.

Karthik Srinivasan, senior VP and gathering head – budgetary segment evaluations, ICRA, said it will be “trying to intrigue oversee edges”. The impact will be seen on the gradual credit book since just new advances will be connected to outside benchmark. The remarkable credits will at present be represented by existing guidelines.

Change to outer benchmark from the current loan fee framework —, for example, MCLR, or base rate, or prime loaning rate and so on — will proceed till reimbursement or recharging, by and large.