Freeing up such transactions were to give further impetus for such digital retail payments.

Current Affairs:India moved to nonstop installment move framework powerful Monday, joining just a bunch of nations all inclusive to do as such. Over it, the Reserve Bank of India (RBI) said successful January 1, banks ought not charge anything to their investment account holders for benefiting such an office through on the web or portable modes.

From Monday, the office got actuated, and banks have begun offering their clients nonstop NEFT administrations, aside from a thirty minutes break after 12 PM at times.

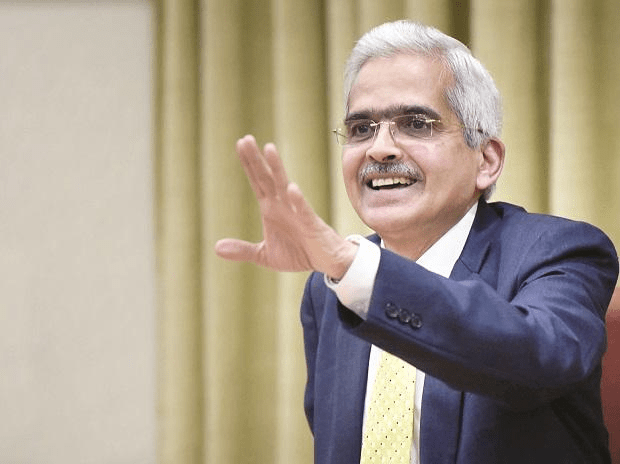

Prior, successful July 1, the RBI had deferred handling charges it for exchanges prepared in NEFT. A week ago, the RBI had opened a unique window for settlement of the NEFT exchanges. On Monday, between 12 am to 8 am, over 1.14 million exchanges were settled, as per the national bank. This, as indicated by RBI Governor Shaktikanta Das, is RBI’s push to offer Indian clients a bunch of e-installment choices. Opening up such exchanges was to give further force for such advanced retail installments.

“The RBI joins a tip top club of nations having installment frameworks which empower nonstop finances move and settlement of any worth,” RBI tweeted.