International money managers are starting to fall out of love with Narendra Modi

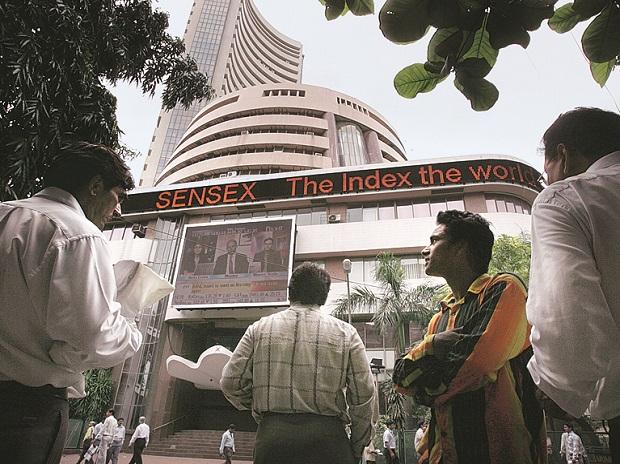

Current Affairs :-In the wake of emptying $45 billion into India’s financial exchange in the course of recent years on expectations that Modi would release the nation’s monetary potential, universal cash chiefs are currently loosening up those bets at the quickest pace on record. They’ve sold $4.5 billion of Indian offers since June, on course for the greatest quarterly mass migration since in any event 1999.

“The rapture around Modi before 2014 has decreased,” said Salman Ahmed, the London-based boss venture strategist at Lombard Odier Investment Managers, which supervises about $52 billion.

It’s difficult to blame financial specialists for losing confidence. India’s financial development has decelerated for five straight quarters to the weakest level since mid 2013, one year before Modi ended up head administrator. Furthermore, the 5% feature number for the subsequent quarter may really downplay how agonizing the lull has moved toward becoming. Vehicle deals are sinking at the quickest pace on record, capital venture has dove, the joblessness rate has flooded to a 45-year-high and the country’s financial framework is hamstrung by the world’s most noticeably terrible awful credit proportion. Monday’s oil-value spike includes one more headwind for a nation that imports the majority of its rough.

While Modi isn’t standing around as the economy debilitates, financial specialists state he’s been delayed to follow up on a considerable rundown of required changes that incorporates selling stakes in state-possessed organizations and patching up the country’s work laws. The developing stress is that India could be set out toward a basic log jam that beats the nation’s $2 trillion financial exchange, messes up development plans of global organizations from Amazon.com Inc. to Netflix Inc., and makes it progressively hard for Modi’s Bharatiya Janata Party to convey employments for the a huge number of youthful Indians who enter the workforce consistently.

Subramanian Swamy, a BJP official, talked obtusely about the dangers of inaction in a meeting with BloombergQuint distributed Sept. 5: “If the economy isn’t corrected, Modi has around six additional months till individuals start testing him.”

Agents from the head administrator’s office, account service and BJP didn’t react to demands for input. India is an alluring venture goal, offering a monstrous market just as nearby ability, political strength and a debasement free, change arranged government, Technology Minister Ravi Shankar Prasad said at an industry occasion on Monday. In spite of the ongoing surges, outsiders’ net stock buys of $6.8 billion this year is the most noteworthy after China among Asian markets.