India’s company debt market remains puny compared with the funding needs of the $2.6 trillion economy

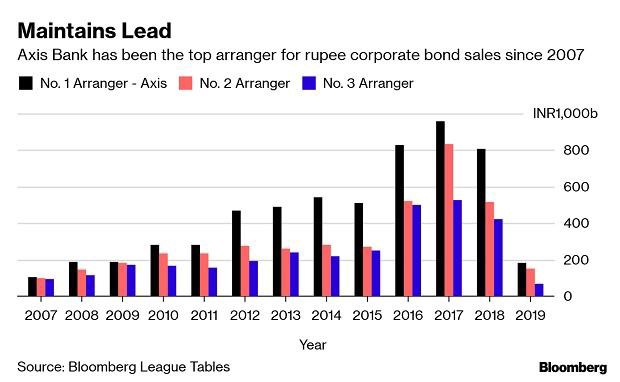

Markets:Shashikant Rathi, who has commanded India’s neighborhood bond endorsing business for over 10 years at Axis Bank, says the business presently faces its greatest test since the worldwide money related emergency.

Stun defaults since a year ago by shadow bank IL&FS gathering and another electronic offering stage have upset the $108 billion market where financiers like Rathi help organizations fund-raise by selling obligation securities. Offers of rupee corporate bonds that will in general pay the most elevated charges have fallen this quarter to a 2016 low.

“The market is in finished disarray,” Rathi, the 41-year-old official VP and head of treasury and markets at Axis Bank in Mumbai, said in a meeting. “I haven’t seen such an emergency since the 2008 Lehman chapter 11.”

Shashikant Rathi, who has ruled India’s nearby bond endorsing business for over 10 years at Axis Bank, says the business currently faces its greatest test since the worldwide money related emergency.