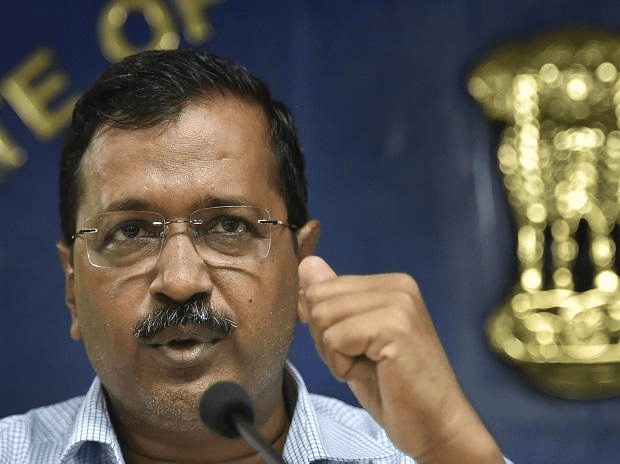

According to Arvind Kejriwal, under the current modelDelhi gets far less than what it contributes as income tax

Current Affairs :-Delhi Chief Minister Arvind Kejriwal has said that the national capital ought to be incorporated into the fifteenth Finance Commission, on the lines of Jammu and Kashmir, so it may get a higher portion of focal duties.

The Finance Commission, set up under Article 280 of the Constitution of India, accommodates the dispersion of net expense continues from the Center to states and furthermore decides the standards administering awards in-help of income of state from the Consolidated Fund of India. Notwithstanding, the Commission doesn’t think about Union Territories as states or decide any standards for award in-help.

Attributable to its status as an UT, Delhi gets a fixed total of assets from the Union home service. In a meeting with The Economic Times, Kejriwal said this aggregate was far not as much as what Delhi contributed as annual expense.

“Delhi contributes Rs 1.75 trillion as personal assessment to the Center however gets back just Rs 325 crore for its own improvement. We are second just to Mumbai in our duty commitment yet get assets lower than Goa (Rs 3,500 crore) and Gujarat (Rs 2,500 crore),” Kejriwal said.

He refered to Jammu and Kashmir’s guide to state that a comparable exception ought to be made for Delhi also.

The Jammu and Kashmir Reorganization Act, 2019, accommodates the President to allude to the fifteenth Finance Commission to incorporate the Union Territory of Jammu and Kashmir in its Terms of Reference. This will permit J&K, presently an UT with lawmaking body, to get the advantages of devolution of focal expenses, something that it had been formerly appreciating as a “state”.

“Jammu and Kashmir was made an UT (with governing body). Delhi was forgotten about. They ought to incorporate Delhi as well. The Center bears the expense of the Union Territory. At that point, there is an express that has its own financial limit and consumption. Delhi is neither a state nor a Union Territory,” Kejriwal said.

“We have just recorded a case in the Supreme Court that terms of the Finance Commission ought to be altered and Delhi ought to be incorporated into that,” he said.

In a meeting with Business Standard a month ago, Chairman NK Singh had said the Fifteenth Finance Commission was not thinking about the requests of Delhi and Puducherry to give them a portion of the distinguishable focal duty pool in accordance with different states.

“We are not officially considering the notice of Puducherry and Delhi on the grounds that under the Constitution, we are not ordered to do as such, and we need to carefully act as per the Constitution,” Singh had said in a communication not long ago.